“Antifragile” by Nassim Nicholas Taleb

Holy shit. This book is really good, but not the easiest to read.

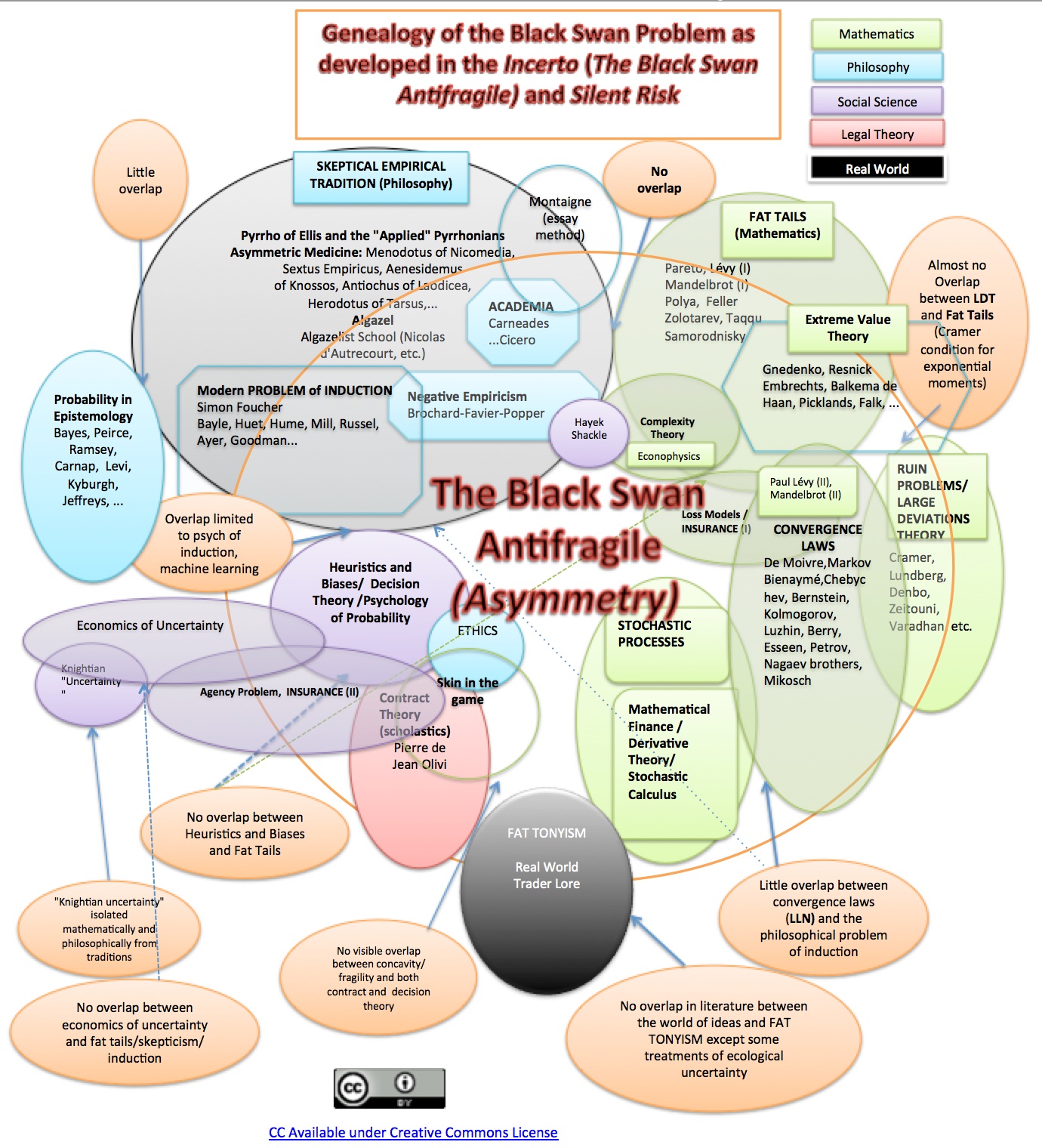

Essentially, it’s about something called Post-Traumatic Growth and probability and … well, why don’t we use this simple graphic from Taleb’s website to illustrate his concept…

Some of my favorite quotes:

6: I want to live happily in a world I don’t understand

10: In short, the fragilista is one who makes you engage in policies and actions, all artificial, in which the benefits are small and visible, and the side effects potentially severe and invisible

17: And for those who think that academia is “quieter” and an emotionally relaxing transition after the volatile and risk-taking business life, a surprise: when in action, new problems and scares emerge every day to displace and eliminate the previous day’s headaches, resentments and conflicts. A nail displaces another nail, with astonishing variety.

45: Tell the next MBA analyst or business school professor you run into that redundancy is not defensive; it is more like investment than insurance. And tell them that what they call “inefficient” is often very efficient.

73: Some businesses love their own mistakes. Reinsurance companies, who focus on insuring catastrophic risks (and are used by insurance companies to “re-insure” such non-diversifiable risks), manage to do well after a calamity or tail event that causes them to take a hit. If they are still in business and “have their powder dry” (few manage to have plans for such contingency), they make it up by disproportionally raising premia–customers overreact and pay up for insurance. They claim to have no idea about fair value, that is, proper pricing, for reinsurance, but they certainly know that it is overpriced at times of stress, which is sufficient for them to make a long-term shekel. All they need is to keep their mistakes small enough so they can survive them.

85: For a self-employed person, a small (nonterminal) mistake is information, valuable information, one that directs him in his adaptive approach; for someone employed, a mistake is something that goes into his permanent record, filed in the personnel department. Nature loves small errors, humans don’t–hence when you rely on human judgment you are at mercy of a mental bias that disfavors antifragility.

153: When Zeno of Kition, the founder of the school of Stoicism, suffered a shipwreck, he declared himself lucky to be unburdened so he could now do philosophy. The key phrase reverberating in Seneca’s oeuvre is nihil perditi, “I lost nothing,” after an adverse event. Stoicism makes you desire the challenge of a calamity.

165: The barbell businessman-scholar situation was ideal; after three or four in the afternoon, when I left the office, my day job ceased to exist until the next day and I was completely free to pursue what I found most valuable and interesting. When I tried to become an academic I felt like a prisoner, forced to follow others’ less rigorous, self-promotional programs. //And professions can be serial: something very safe, then something speculative.

197: Whenever an economic crisis occurs, greed is pointed to as the cause // we cannot change humans as easily as we can build greed-proof systems, and nobody thinks of simple solutions. // Likewise “lack of vigilance” is often proposed as the cause of an error. But lack of vigilance is not the cause of the death of a mafia don; the cause of death is making enemies, and the cure is making friends.

208: I was told that he was the biggest Swiss franc trade in the world // I thought he was Swiss Italian, yet he did not know there were Italian-speaking people in Switzerland. // I started freaking out watching all these years of education evaporating in front of my eyes. That very same day I stopped reading economic reports. I felt nauseous for a while during this enterprise of “deintellectualization”–in fact I may not have recovered yet.

213: As Yogi Berra said, “In theory there is no difference between theory and practice; in practice there is.”

220: Trades trade > traders figure out techniques and products > academics economists find formulas and claim traders are using them > new traders believe academics > blowups (from theory-induced fragility)

229: Academics were mostly just teachers, not researchers, until well into the twentieth century.

230: 1/N is the argument Mandelbrot and I used in 2005 to debunk optimized portfolios and modern finance theory on simple mathematical grounds; under Extremistan effects, we favor broad, very broad diversificaton with small equal allocations rather than what modern financial theory stipulates.

381: Anyone producing a forecast or making an economic analysis needs to have something to lose from it, given that others rely on those forecasts (to repeat, forecasts induce risk taking; they are more toxic to us than any other form of human pollution).

419: Science must not be a competition; it must not have rankings–we can see how such a system will end up blowing up. Knowledge must not have an agency problem.